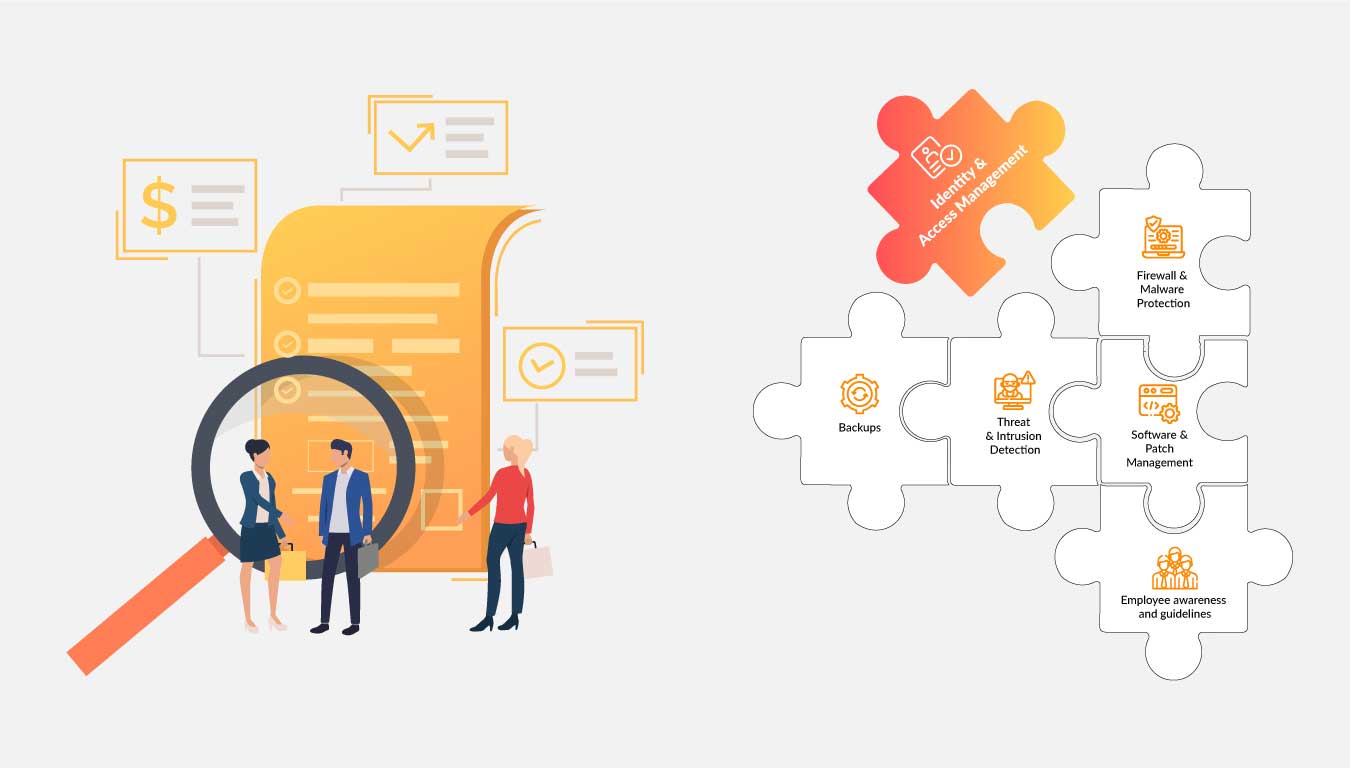

Identity & Access Management as a core building block of cyber insurance: reporting and recertification

Which reporting options are relevant in Identity & Access Management?

A modern Identity & Access Management offers extensive reporting functionalities. For cyber insurance, user reporting and authorization management are particularly important. Reporting refers to the process of generating and analyzing reports that provide insight into identity and access activities in an IT environment. Detailed reporting allows organizations to track which users are accessing and allowed to access which resources to identify potential security risks and meet compliance requirements. Going further, recertification is an essential step that builds on top of reporting, ensuring that existing access rights and authorizations still meet current requirements. The access rights of the users are regularly checked and re-authorized, e.g., by a supervisor. This check and renewed authorization or confirmation can be carried out manually or automatically, depending on the use case. The recertification process helps to prevent misuse and misconfigurations. Especially since outdated permissions, which a user should not (or no longer) have, are a risk factor for data breaches and leaks, as well as often a compliance issue.

What are the benefits of reporting and recertification for a cyber insurance?

A regular recertification of access rights helps to minimize the risk of insider threats and unauthorized access. Implementing these IAM applications helps strengthen the security posture of organizations, reduce potential claims, and ultimately increase the appeal for cyber insurance. Thus, demonstrating a comprehensive and end-to-end Identity & Access Management implementation – from multifactor authentication to good reporting and recertification – can positively impact insurance premiums.

Depending on the design of the cyber insurance policy, the insurance company can be integrated into the reporting. Comprehensive reporting on identity and access activities can help insurance companies gain a clearer understanding of their policyholders’ security posture. This enables a well-founded risk assessment and pricing of cyber insurance policies.

The possibilities of a modern IAM system are manifold. As we have seen, there are immense advantages, especially in the context of cyber insurance. Comprehensive reporting tools enable organizations to closely monitor identity and access activities, mitigate potential security risks, and meet compliance requirements. Periodic recertification of access rights acts as a shield against insider threats and unauthorized access.

With cidaas we offer you a solution that goes far beyond traditional boundaries. Seamless integration of multifactor authentication, world-class reporting, and thoughtful recertification paves the way for a secure digital future. Not only will your cyber insurance policy be strengthened, but our IAM practices can also make it more attractive to insurance companies.

Discover the power of a robust IAM system and lay the foundation for a more secure digital future.

On our page – Identity & Access Management for Cyber Insurances – you can learn more about how cidaas can help with the implementation of cyber insurance requirements.

Read also our other blog parts on the topic “Identity & Access Management as a basic building block of cyber insurance”:

- Identity & Access Management as a basic building block of cyber insurance: multi-factor-authentication

- Identity & Access Management as a Basic Building Block of Cyber Insurance: Authorization Management

- Identity & Access Management as a basic building block of cyber insurance: Detecting cyber attacks